Despite finalizing the United-States-Mexico-Canada Agreement (USMCA) as a sweeping replacement for NAFTA in 2020, the Trump administration has signaled that it might want to change things up or perhaps even do away with the trade deal upon its next review. This has placed member nations and the relevant industries, particularly the automotive sector, on high alert.

While we can argue about the pros and cons of outsourced labor and the nuances of trade relationships, multinational corporations often feel as though they’ve outgrown (for lack of a better term) their countries of origin. Automakers operate on a global scale, with extended schedules that require loads of advanced planning and collaboration between nations. So they’re typically interested in trade laws that either allot them more industrial freedom or maintain the status quo.

Under USMCA, Trump called for increased content requirements within the automotive industry in an effort to maintain domestic employment (and the related talent pools) while likewise improving labor standards across North America. However, critics were concerned that increased content requirements could result in higher vehicle costs — something the White House said could be offset by lessening certain regulations.

This pertained mainly to rules pertaining to emissions and safety requirements. But we didn’t see much change on their front (at least insofar as passenger cars were concerned) until 2025.

Now, the Trump administration has suggested that the USMCA might need to be altered upon its next review. This is required to take place in the middle of 2026 and could have sweeping ramifications for numerous industries, including the automotive realm, if changes are made.

Officially, the White House has said very little on the matter. But we do know that Donald Trump suggested the United States could renegotiate the trade deal or even dump it entirely — requiring separate deals for both Canada and Mexico.

That said, Trump frequently likes to keep parties guessing as to what his next move will be. The logic here is that having someone assume that the worst could happen will make them more accommodating when it comes time to negotiate. We’ve seen this tactic deployed countless times before, to varying degrees of success.

However, that doesn’t mean the involved nations can simply assume everything is a bluff. The same goes for the companies that could be impacted.

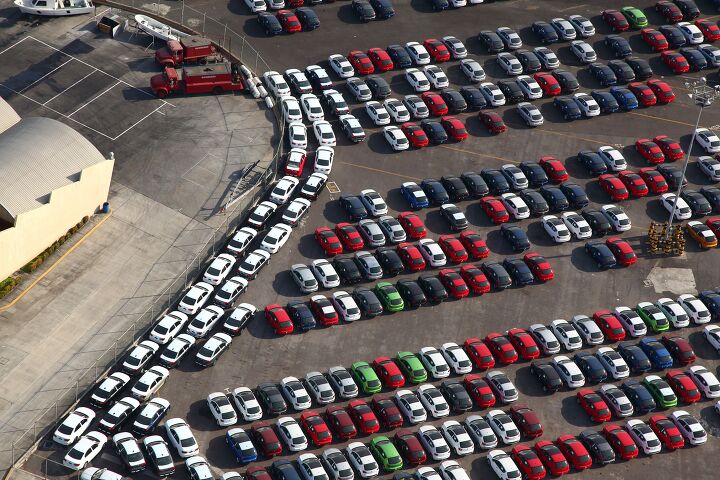

Mexico has seen massive investments into the automotive industry over the last decade. Loads of automakers, including those based in the United States, have set up factories there and the nation has become one of the biggest vehicle exporters in the world.

While Canada produces far fewer vehicles, it has remained relevant, particularly in relation to Ontario exporting vehicles into the United States. But Canada’s automotive aspirations are clearly on the decline, especially in comparison to what’s been happening inside Mexico.

For those wondering what changes to the USMCA might look like on the ground, Car and Driver and Autoweek both recently published speculative takes on how things might change should the United States pivot individualized trade negotiations:

According to Jessica Caldwell, Edmunds’ head of insights, “A move to replace the USMCA with separate agreements for Mexico and Canada would introduce new and cumbersome challenges for the auto industry. Automakers have built their supply chains around a highly integrated North American system, with parts moving back and forth across borders. If that framework starts to change—whether through new tariffs or different rules—costs rise, production becomes more complex, and consumers might start to feel it in higher vehicle prices. After the past five years, stability is something the auto industry needs more of, and this kind of shift adds to the uncertainty.”

Alexander Edwards, president of Strategic Vision, agrees. “The auto industry can adapt to almost any rule,” he said. “What it can’t absorb cheaply is uncertainty and multiple overlapping rulebooks.”

American automakers are also supportive of USMCA, though they choose their words carefully. American Automotive Policy Council (AAPC) President Matt Blunt said in Congressional testimony on December 4, “The agreement’s strong rules of origin have driven major increases in U.S. automotive investment, production, and employment, contributing significantly to U.S. economic security. As the Joint Review moves forward, AAPC urges the administration to preserve the core structure of the USMCA while pursuing targeted refinements, adequate transition periods, and measures that further incentivize North American supply chain resilience.”

Rising costs are something everyone brings up when someone smells change on the horizon. It happened when the USMCA was introduced and it’s happening now. But there is a good reason for that. Building new facilities and shifting supply lines is often a costly and time consuming endeavor, especially when both are taking place at a global scale. But it doesn’t necessarily mean prices would remain high.

Mentioning price increases are often used as a scare tactic to discourage public support. Sometimes businesses will also utilize any changes as an excuse to increase pricing as a way to improve their profit margins. But smart implementation can certainly lower prices over time, particularly if customers indicate that they’re not willing to pay extra. The issue is that it rarely happens quickly and depends heavily on other factors, including material prices and domestic wages.

Still, it’s extremely that repeatedly throwing curve balls at the automotive sector (or any industry) is unlikely to result in stable pricing. No matter how trade deals are handled, the relevant companies need time to plot out production. Rules that would require the establishment of new factories or spend money on additional tariffs would almost assuredly increase production costs.

Automakers would presumably prefer to maintain the status quo and support changes that resulted in their seeing more government subsidization. Any new tariffs or content restrictions aren’t likely to go over well with industry executives. But that assumes the Trump administration even bothers to make major changes that would impact automobiles.

Upon the summer review of the USMCA, the United States may decide that no changes are necessary or that tweaks should impact other aspects of trade — leaving the automotive sector alone.

Even if the USMCA were done away with, Canada likely wouldn’t be as put off by the automotive impacts as it would be by changes to other sectors. The Canadian government talks a big game about its auto industry. But it hasn’t actually seemed terribly focused on doing whatever it takes to maintain its present production levels.

Mexico, however, would probably be sent reeling by the mere prospect of losing automotive jobs or having to pay even higher tariffs should the peasant USMCA content requirements be changed.

It’s likely we’ll be hearing more about how the United States plans on handling the trade review as we draw closer to the summer months — as it may help us predict what’s to come. In the interim, it’ll pay to watch how tariffs progress. Importation fees have been far more relevant this year and are likely to continue to be unless the Trump administration decides to revise its trade tactics for 2026.

[Images: John Gress Media Inc/Shutterstock; Aldo91/Shutterstock; Joraca/Shutterstock]

Become a TTAC insider. Get the latest news, features, TTAC takes, and everything else that gets to the truth about cars first by subscribing to our newsletter.